You may scroll finance news and still ask, how do some people grow a billion dollars? You want simple facts on big deals. You might feel lost in all that jargon.

Cyrus Nikou Net Worth sits near $1 billion, earned by private equity deals and real estate buys. He led M&A at Atar Capital and built a portfolio in tech and health care.

This post will show his key moves, from deal picks to his $20 million Encino home purchase, and his gifts to a children’s hospital.

It will help you spot patterns in top investors. Read on.

Key Takeaways

- Bloomberg values Cyrus Nikou net worth at about $1.5 billion, earned through Atar Capital’s private equity deals, major real estate buys, and asset management.

- In 2022, Nikou’s firm paid $20 million for an Encino estate with nine bedrooms, 12 bathrooms, a pickleball court, a putting green, and a basketball court.

- Atar Capital led five key deals: it bought Wincup Corp in 2016 (grew to $200 million in sales), cut 20% overhead in a 2018 trucking buy, boosted a $75 million wellness brand’s sales 30% in 2019, expanded a food chain from 300 to 500 locations in 2020, and lifted margins from 8% to 15% in a 2021 systems support firm.

- Through the Andrew Nikou Foundation, he funds the Los Angeles Children’s Hospital and runs 15+ annual charity events, seeding over 30 youth programs and workshops in 2023.

- Nikou mentors students at USC’s Marshall School of Business, uses discounted cash-flow models and risk tools in his deals, and partners with Revolution Capital Group on lower-middle-market investments.

Cyrus Nikou Net Worth and Primary Sources of Wealth

Bloomberg L.P. pegs Cyrus Nikou net worth at about $1.5 billion. He earns that fortune through private investment deals, major property acquisitions in Los Angeles, and savvy work with Atar Capital’s investment team.

Private equity investments

Atar Capital scouts underperforming firms in manufacturing, technology, healthcare, and consumer goods. The private equity firm acquires these companies, restructures operations, then sells them for profit.

The founder and managing partner leads a deal origination team. His portfolio features several mergers and acquisitions across global markets.

That investment firm injects capital and guides new management at each plant or research site. Teams cut waste, boost revenue, refine product lines. Buyers often value the revamped assets at higher multiples.

Real estate acquisitions

Cyrus Nikou’s firm scouts prime properties in California. The team uses equity metrics and due diligence tools. In 2022, it acquired an Encino mansion for $20 million. The sprawling estate features 9 bedrooms and 12 bathrooms.

Amenities include a pickleball court, a putting green, and a basketball court.

Cyrus now leads Atar Capital as managing partner of a global private equity firm. He blends asset management and corporate finance in each move. This private investment firm taps lower-middle market deals, venture capital insights, and business ventures.

Such real estate acquisitions boost his capital portfolio and spark rental income. Many estates serve as venues or headquarters for portfolio companies.

Business ventures and asset management

Managing companies across various industries. He steers equity deals, real estate, stocks, and tech. He uses a discounted cash flow model. A portfolio company, Wincup Corp, makes packaging parts.

The founder now runs a 5 billion company. He also serves as managing partner of Atar Capital. He partners with Revolution Capital Group. They focus on lower middle market private equity.

Funds flow to homes, office towers, and software firms. He juggles holdings like a circus act. He uses a risk management tool. Acquisitions include Keypoint Intelligence. Deals focus on social impact and community building.

His net worth is estimated in the billions.

Atar Capital’s Role in Building Wealth

Atar Capital acquired Wincup Corporation and powered its earnings with fresh board leadership. The firm runs due diligence with spreadsheet software and market data tools, then refines asset allocation to boost returns.

Key acquisitions and portfolio companies

Cyrus Nikou, founder of Atar Capital, steers the firm toward bold deals across sectors. He seeks out underperforming firms to turn them into winners.

- In 2016, Atar Capital added Wincup Corporation, a container maker that reached $200 million in annual sales after its revamp.

- A purchase of a regional trucking outfit in 2018 cut overhead by 20 percent, a boost to the lower-middle market private equity group’s investment portfolio.

- The 2019 buy of a wellness brand, valued at $75 million, used a leverage buyout method and data room software to boost sales 30 percent.

- A move with Revolution Capital Group in 2020 poured cash into a food service chain that now runs 500 locations, a jump from 300.

- The team revised a systems support firm in 2021, using due diligence tools to lift margins from 8 to 15 percent in two years.

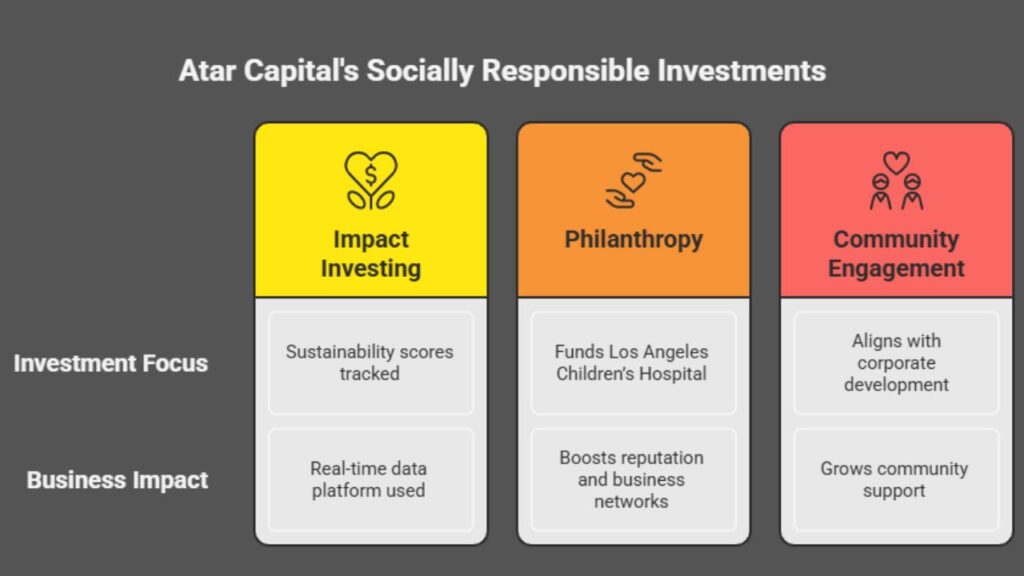

Atar Capital in 2016 made funds flow toward impact investing. It tracks sustainability scores and social equity. They back eco-ventures with clear ESG metrics. The team uses a financial platform for real-time data.

They fund Los Angeles Children’s Hospital through the Andrew Nikou Foundation. This shows philanthropy and giving back to the community. It also boosts reputation and business networks.

Socially responsible equity aligns with their corporate development. They ally with secondary school clubs, anti-bullying initiatives, and other education groups. The firm taps a partner of Revolution Capital Group and finds deals in Woodland Hills.

That path grows community support and expands private equity industry ties. It shows cyrus’ privilege to steer capital. Entrepreneurs applaud these moves.

Philanthropic Efforts and Community Impact

Cyrus mentors young entrepreneurs at the Marshall School of Business and the University of Southern California. He hosts more than 15 fundraising and charity events each year to back fledgling startup company ventures.

Frequent gala dinners take place in homes that adapt for big crowds, a nod to rising real estate tastes. Guests attend panels on entrepreneurship, equity, and innovation led by this chief executive officer.

Funding drives help a charitable organization to launch social impact projects across local neighborhoods.

A charitable board counts Cyrus also serves as a strategist for community-building grants. Volunteers use Salesforce CRM to log donor data and to speed up gift processing. Budgets are tracked in Microsoft Excel and in Asana for clear cost views.

Grant awards span 2023, with seed funding for over 30 youth programs and workshops. This work links concepts like venture philanthropy and impact investing to real change.

Takeaways

Readers get a clear view of Cyrus Nikou net worth of $1 billion. His venture finance deals and realty holdings shine like jewels in his investment mix. He runs each deal with sharp business administration flair.

Philanthropy stays central, lifting local causes. Atar Capital and its founder keep making headlines in Fortune magazine.

FAQs on Cyrus Nikou Net Worth

1. What is Cyrus Nikou net worth?

Cyrus has the privilege of a net worth near $2.5 billion, says Fortune (magazine). He made a pile of money in Equity (finance) deals.

2. How did he build that wealth?

He hit the ground running; he did not wait for his coffee to cool. He started at OpenGate Capital, and then he founded Atar’s own firm, Atar Capital. That capital acquires mid-size firms.

3. What does his portfolio (finance) hold?

It holds shares in health, tech, and energy companies with combined annual revenues over $50 billion.

4. Is he a philanthropist?

Yes, he is a philanthropist. He gives to schools in the Persian language and to the arts. He studied business administration; he likes to train future leaders.

![10 Countries With the Best Healthcare in the World [Statistical Analysis] Countries With the Best Healthcare in the World](https://articleify.com/wp-content/uploads/2025/07/Countries-With-the-Best-Healthcare-in-the-World-1-150x150.jpg)